Dr Fabian Stephany

Departmental Research Lecturer

Fabian is a Departmental Research Lecturer in AI & Work at the Oxford Internet Institute.

A summary of The CoRisk-Index: A data-mining approach to identify industry-specific risk assessments related to COVID-19 in real-time

The COVID-19 pandemic has forced governments around the world to take countermeasures with drastic consequences. In order to mitigate the economic effects, governments have initiated unprecedented aid packages. In light of the extremely volatile development of the crisis, policy makers urgently require up-to-date empirical information about the economic situation. We propose the CoRisk-Index, a real-time measure of industry risk assessments associated to COVID-19. The index can help to complement more traditional measures of economic activity, as it nowcasts how business perceive their corona-related risk exposure. Preliminary findings suggest that industries, such as Manufacturing and Retail, report strong exposure to supply and demand shocks early on, while services sectors, such as Finance, only recently started to report about corona-related risks. Moreover, we find that negative sentiment of reports mentioning corona preempts global stock market developments. The CoRisk-Index will be updated constantly, throughout the crisis, and it allows researchers and the general public to get a comprehensive view on how industries assess economic risks related to COVID-19.

With COVID-19 reaching the level of a pandemic, governments and companies around the world are exposed to the resulting risks for the highly interconnected global economy. To slow down the spread of COVID-19, governments in China, Europe, the US, and beyond are taking drastic measures, such as travel warnings, border and store closures, regional lockdowns, and curfews. These measures are having fundamental consequences for personal freedom and the economy. While general market expectation in almost all industries have declined, businesses are affected by the pandemic in various ways: travel bans set business meetings off schedule, economic shocks disrupt global supply chains, and store closures erase customer demand.

In an attempt to mitigate the general economic downturn, governments all over the world are providing considerable financial support. Many of these immediate aid packages are not targeted to specific industry needs, but are meant to support businesses in all parts of the economy. While such general programmes play a crucial role in stabilising financial markets in the short term, it is paramount for their long-term effectiveness to concentrate support to those areas of the economy that are most at risk. However, in the current situation, policy-makers lack reliable and up-to-date empirical data, which would help to better assess industry-specific economic risks in real-time. Such information could help to improve macroeconomic forecasts and thus inform policy makers.

In order to identify industry-specific risks associated with COVID-19, we explore a source of data that could provide an empirical basis to monitor industry-specific economic risks related to COVID-19. We examine company risk reports (10-K reports) filed to the U.S. Securities and Exchange Commission (SEC) and introduce a data-mining and sentiment approach to measure firms’ risk assessments. While constantly collecting data since January 30th, the first time a company has mentioned COVID-19 in one of their reports, we are able monitor the magnitude, context, and timing of the risk that businesses attribute to COVID-19. We have summarised the analysis of this data in a working paper and illustrated the main findings in an interactive online dashboard which is updated on a weekly basis. In the following, we present three exemplary findings:

1.Industries assess COVID-19 risks differently. While the majority of firms in retail and manufacturing perceive COVID-19 as a risk, only one in three company in finance has mentioned COVID-19 as a potential risk factor for their businesses. However, we observe that the share of companies reporting on COVID-19 as a business risk is constantly increasing, as the crisis unfolds. The CoRisk Index allows us to monitor this development in real-time.

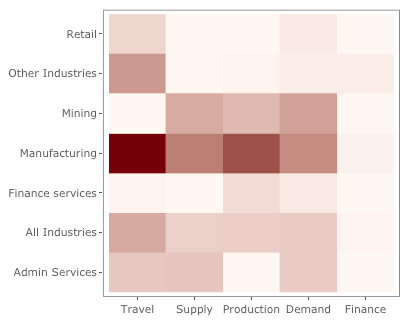

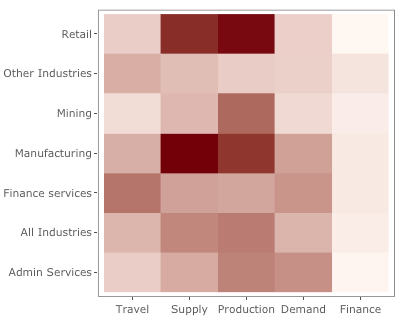

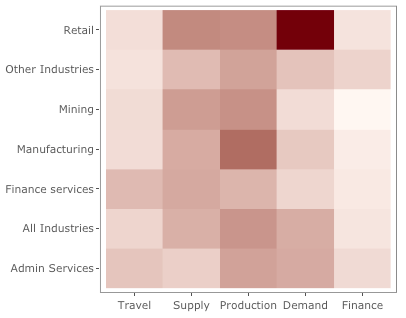

2.The context of COVID-19 risks changes over time. The text analysis of the risk reportings allows us to monitor the context in which businesses are referring to COVID-19. In a heatmap illustration, we can explore the domains (Demand, Finance, Production, Supply, and Travel) for which businesses fear the impact of COVID-19. In the beginning of the pandemic, travel related issues dominated. This changed in late February and March, when Retail and Manufacturing realised that supply chains and production facilities are interrupted (supply shock). As a consequence of the lockdown, Retail firms reported substantial concerns about plummeted demand (demand shock).

3.The CoRisk Index is leading stock market developments. Around mid February, global stock markets started to decline rapidly (blue line), as it became evident that the COVID-19 pandemic would have far-reaching economic consequences. In comparison, the “negativity” of the risk reports (green line) increased already prior to this development (Panel A and B). The text sentiment of the corona-related sentences still leads stock market by around five days (Panel C).

We are constantly improving the CoRisk-Index. It will be updated, on a weekly basis, throughout the whole course of the crisis. This will allow researchers and the general public to get a comprehensive view on how industries perceive economic risks related to COVID-19. Additionally, we are extending the analysis and conducting robustness checks. We hope that our empirical insights might help researchers in forecasting economic effects of the crisis. Ultimately, those insights could support policy makers when crafting measures to mitigate the adverse effects of the pandemic.